With our newsletter beinformed we provide in-depth professional information on hot topics in our specialization. “Latest News” can be found everywhere on the web. But finding out what is important is not easy and time-consuming. Our newsletters do not cover everything, but we carefully identify important issues for our clients and provide in-depth information about these topics.

To get an impression, please have a look at recent newsletters in our newsletter app. If you'd like to be informed about new newsletters via email, please send an email to office@bepartners.pro

With beinformed, we deliver up-to-date information in compressed form to your email account. With our befit events, we go one step further. We regularly prepare current tax and legal information focusing on the investment management industry. Our befit events allow you to get up-to-date information conveniently at your workplace, at our offices in Düsseldorf or Luxembourg, or as an online webinar. Whichever way suits you best! Our speakers will be at your disposal for questions and discussions.

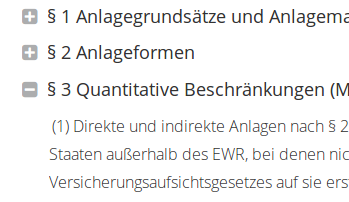

As those who apply the law, we are regularly confronted with new legislation – especially in the investment management industry. Staying current is not easy. To make your life easier, we provide amended digital versions of laws important to the financial industry. We not only highlight changes in these laws; we also include all comments made by the legislator in the explanatory memorandum.

Please note that all amended digital versions are in German.

Let us convince you of the benefits of our digital Statutory Materials and regulations.

Since 1996, we have provided services in relation to the structuring, establishment, marketing and operation of investment funds and investment products. We have incorporated our experiences and knowledge into our beperator document generator. This structured and automated approach allows us to better understand complex legal issues and saves time for your projects.

You can find further information at beperator.bepartners.pro.

There is much high-quality legal information on the public web. However, finding this information is not always easy. For our internal work we maintain bookmarks for important information we use regularly. With our App Pathfinder we make these lists available for your convenience.

The eBook of our colleague Johannes Recker as EPUB or PDF covers the Investment Tax Act Reform 2018. In his thesis Johannes Recker compares the Investment Tax Act 2018 with the Investment Tax Act 2004. He illustrates the differences with the aid of case studies on real estate investment funds, equity investment funds and investment funds for (partial) tax-exempt investors.

Since 1996, we have specialized in the structuring, establishment, marketing and operation of investment funds and investment products. We have incorporated our experiences and knowledge into an online commentary on German investment tax law on the Beck Online platform hosted by the renowned publisher C. H. Beck. Our experience over the years enables us to provide more than purely academic theories. We provide practical solutions. Our online commentary allows us to promptly integrate and comment on statutory amendments, case law, proposed regulations or discussions in legal literature.

Visit our podcast page or listen here right away: